As Chief Minister Pramod Sawant prepares to present Budget today, The Goan takes a look at Goa’s escalating debt situation

PHOTO CAPTIONS -

Table: Public debt of State as on March 31.

-----------------

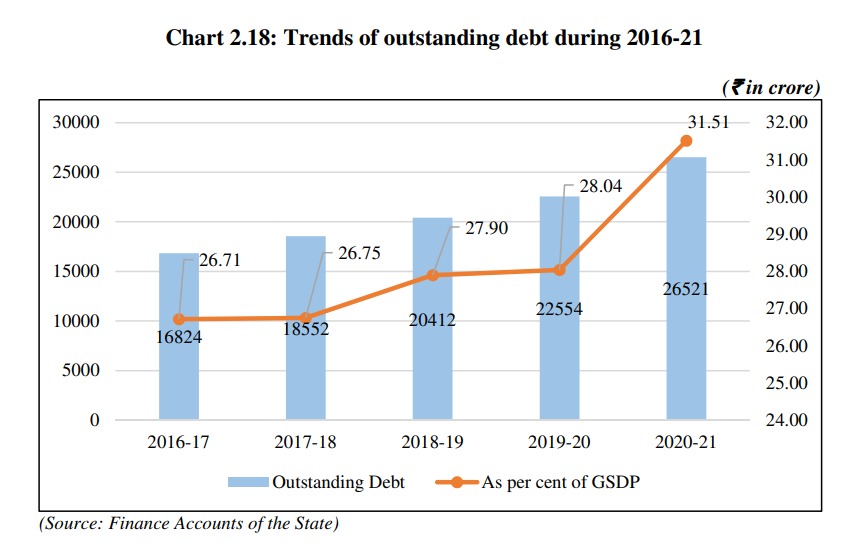

GRAPH 1: Trends of outstanding debt during 2016-2021.

-----------------

GRAPH 2: Debt maturity profile.

===============

INFOBOX

CAG RECOMMENDATIONS ON DEBT

- Given the mounting committed expenditure over the last five years and a revenue deficit during the current year, the State government needs to work out a well-thought-out debt management strategy to avoid falling into a debt trap

- The State government may consider developing a debt sustainability framework for achieving improved long-term sustainability in fiscal deficit management and to guide the borrowing decisions of the State in a way that matches their financing needs with current and prospective repayment

----------------

HEADING -

GOA STARING AT DEBT TRAP

----------------

INTRO -

As CM prepares to present Budget 2023-24 today, The Goan takes a look at Goa’s escalating debt situation

----------------

BYLINE -

ALEXANDRE MONIZ BARBOSA

----------------

Whether we admit it or not, Goa’s financial position is not all that robust, and disregarding the finances will only add to the burden. It is a fact that the State has been consistently borrowing, mainly through the sale of bonds, to improve its financial position. In the current financial year, the government, as admitted in the Legislative Assembly, has availed loans amounting to Rs 1,300 crore. The amount may appear small for a State government, but when it is added to the existing debt figure, the final figure is only growing.

The burden rises

The Economic Survey tabled in the House on Tuesday has placed the accumulated debt figure at Rs 21,940.46 crore for the financial year ending March 31, 2023, as against Rs 20,824.46 crore for the previous year. It gives the breakup of where the government has been borrowing, and market loans are the largest group (See Table). The same report states that internal debt comprises 77.17 per cent of the total capital revenue of the State.

What is pertinent is that as debt increased, the central loans showed a decline and the market loans a sharp increase. In 2015, market loans were at 53.38 per cent of the total debt, while in 2020 it had gone up to 75.34 per cent and the estimate for 2021 was pegged at 78.60 per cent. By 2019, the loans totalled approximately Rs 15,000 crore and considering the budget outlay of over Rs 19,000 crore, the State is paying an interest of 13 per cent, nearly Rs 2,722 crore, just to service the debt.

On the other hand, the Comptroller and Auditor General of India Report for 2020-21 has a debt figure of Rs 26,521 crore for the year ending March 2021. The figures apart, what is clear from this is that the State’s debt is high.

While the Economic Survey does not pass comments, but only states facts supported by figures, there is an interesting change in the current report from that of the past. Even the previous year’s report while stating that the total public debt of the State as on March 31, 2022, (estimated) stood at Rs 20,824.86 crore, had gone on to say, "Public debt of the State is showing an increasing trend."

In 2018, the Economic Survey said, "It is observed that public debt of State is continuously rising." Such statements are missing from the current Economic Survey report.

The debt situation

One needs, however, only to skim through the report of the Comptroller and Auditor General of India for 2020-21, tabled in the Legislative Assembly this January to get a picture of the debt situation. The report has some rather telling observations. It notes that the overall debt of the State government "increased by 53 per cent during the last five years from Rs 16,824 crore in 2016-17 to Rs 26,521 crore in 2020-21." It doesn’t stop there but further notes that "during 2020-21, it increased by 17.59 per cent over the previous year. The total outstanding debt was two-and-a-half times the revenue receipts (Rs 10,440 crore) and almost four times the State’s own resources (Rs 7,054 crore) during 2020-21." (See graph I)

What this amounts to is that the State could face further financial strain as it dips into its reserves to service the debt. As per the CAG report, "49 per cent of the total public debt (Rs 10,212 crore) would be repayable within the next seven years which may put a strain on the government budget during that period. The remaining 51 per cent (Rs 10,518 crore) would become due for servicing after seven years." (See graph II)

Repayment breakup

The same CAG report gives the following breakup of repayments due, where the government would have to "repay market loans of Rs 2,390 crore and pay interest of Rs 3,577 crore in the next three financial years i.e. up to 2023-24." This is up to the current financial year beginning in just a few days from now. It further states, "In the following two years i.e., up to 2025-26, principal of Rs 2,304 crore and interest of Rs 2,006 crore would be payable. The total principal repayment along with interest would be approximately Rs 10,277 crore during the next five years (up to 2025-26)."

Is Goa financially sound to pay back these figures?

That will not end the debt situation, as ‘Between 2026-27 and 2030-31, the State government would have to repay the principal amount of Rs 11,370 crore together with interest of Rs 2,837 crore. As such, the average annual outgo on account of principal and interest during the five-year period (2026-31) would be approximately Rs 2,841 crore."

Debt-GSDP ratio

What’s even more worrying and needs to be reined in is the debt-GSDP ratio. Again the CAG report states that the: "State government has repeatedly breached the target of the debt-GSDP ratio of 25 per cent, set out in Goa FRBM (First Amendment) Act, 2014 during the last five years. In fact, the debt-GSDP ratio increased from 26.71 per cent in 2016-17 to 31.51 per cent in 2020-21." On the other hand, the Economic Survey states that the debt to GSDP ratio is at 24 per cent.

Merely borrowing and attempting to justify that the State is within the borrowing limits will not change the situation that Goa is facing or is fast-forwarding towards.

In a discussion in the Assembly during the current session, Chief Minister Pramod Sawant has been quoted in a newspaper as having said, "Our limit for the financial year 2022-23 was Rs 3,200 crore, but the government has availed loans of only Rs 1,300 crore. So the remaining amount of loans would be added to the next financial year." What this essentially means is that with this addition, the government can avail of a much larger amount in loans in the coming fiscal, which even if within the borrowing limit, will add to the growing debt figure.

Sale of bonds

What the sale of bonds is doing is meeting the demands of government payments, but resulting in adding to the debt figure and increasing the debt burden on the State. Every sale of bonds comes at a cost of interest repayment. Currently, loans from the open market form the highest component of the State’s debt figure and Goa has crossed the debt to GSDP ratio. The figures are all available in the reports of the Comptroller and Auditor General of India and the Goa State Economic Survey.

Sustainability indicators

Further, an analysis of debt sustainability indicators for Goa by the CAG revealed that the situation is not all that blue for Goa. Debt is considered sustainable if the borrower, in this case, Goa, is in a position to service its debt.

The CAG report stated, "A sustainable fiscal policy is one where debt-GSDP ratio is stable or declining over a period. However, the debt-GSDP ratio shows an increasing trend during the last four years (2017-21), which means higher levels of debt which in turn leads to higher deficits."

It goes further to state that during the past three years (2018-21), "Outstanding public debt grew at a faster rate than GSDP. During 2020-21, the rate of growth of outstanding public debt was 22.71 per cent as against the growth rate of GSDP at 1.31 per cent."

Interestingly, it also stated that: "Persistently higher interest payments leave fewer funds for public expenditure. The share of interest payment in revenue receipts showed an increasing trend from 9.03 per cent in 2017-18 to 12.91 per cent in 2020-21."

CAG suggestions

The CAG has made two pertinent recommendations on debt for Goa. It suggested a debt management strategy to avoid falling into a debt trap and developing a debt sustainability framework for achieving improved long-term sustainability in fiscal deficit management and to guide the borrowing decisions of the State in a way that matches their financing needs with current and prospective repayment.

Goa, it is obvious, requires a debt management strategy. It has been consistently recommended by experts. There is no reason to keep putting off what is necessary.